Building trust with prospective clients in financial advice: The role of social proof

In the competitive landscape of financial advice, trust is the cornerstone of any successful advisor-client relationship. But how do you build this trust, especially with new clients who are unfamiliar with your unique value and offerings? The answer lies in leveraging one of the most powerful tools in your marketing arsenal: social proof.

Harnessing the power of social proof

Social proof, the phenomenon where people copy the actions of others in an attempt to emulate behaviour in certain situations, is particularly effective in the financial advice sector. It's a way to showcase that your advice is valued, effective, and trusted by others, which can significantly influence prospective clients' decisions to engage your services.

Types of social proof

We've broken down the most relevant types of social proof for financial advisors.

Client testimonials: Personal stories and endorsements from satisfied clients are incredibly compelling. They provide a relatable narrative for prospective clients, highlighting how your services can solve real-world financial challenges.

Case studies: Detailed accounts of how you've helped clients achieve their financial goals can illustrate your approach and effectiveness, providing a blueprint for potential success that prospective clients can expect.

Media mentions: Being featured in reputable publications or financial news outlets broadens your visibility and marks your brand with authority and trustworthiness.

Professional endorsements: Recognition from industry bodies or fellow professionals adds another layer of credibility, showing that your expertise is respected within the financial community.

Collecting and showcasing authentic social proof

Gathering social proof begins with delivering exceptional service that makes clients want to share their experiences. After ensuring satisfaction, don’t shy away from asking for testimonials. A simple, personalised request can yield positive responses.

For impactful case studies, identify clients who have seen significant benefits from your financial advice and ask if they're willing to share their journey. Make this process easy for them, perhaps by offering to draft their story for their approval.

Remember, the goal is to weave social proof seamlessly into your communication channels, making it a natural part of your narrative rather than an overt marketing push. Authenticity is key—ensure that all testimonials and case studies are genuine and verifiable.

Leverage digital platforms for social proof

Social proof is a versatile element that enhances the effectiveness of all your marketing efforts, driving home the message that your financial advice is trusted, valued, and effective. Digital platforms offer diverse avenues for sharing social proof.

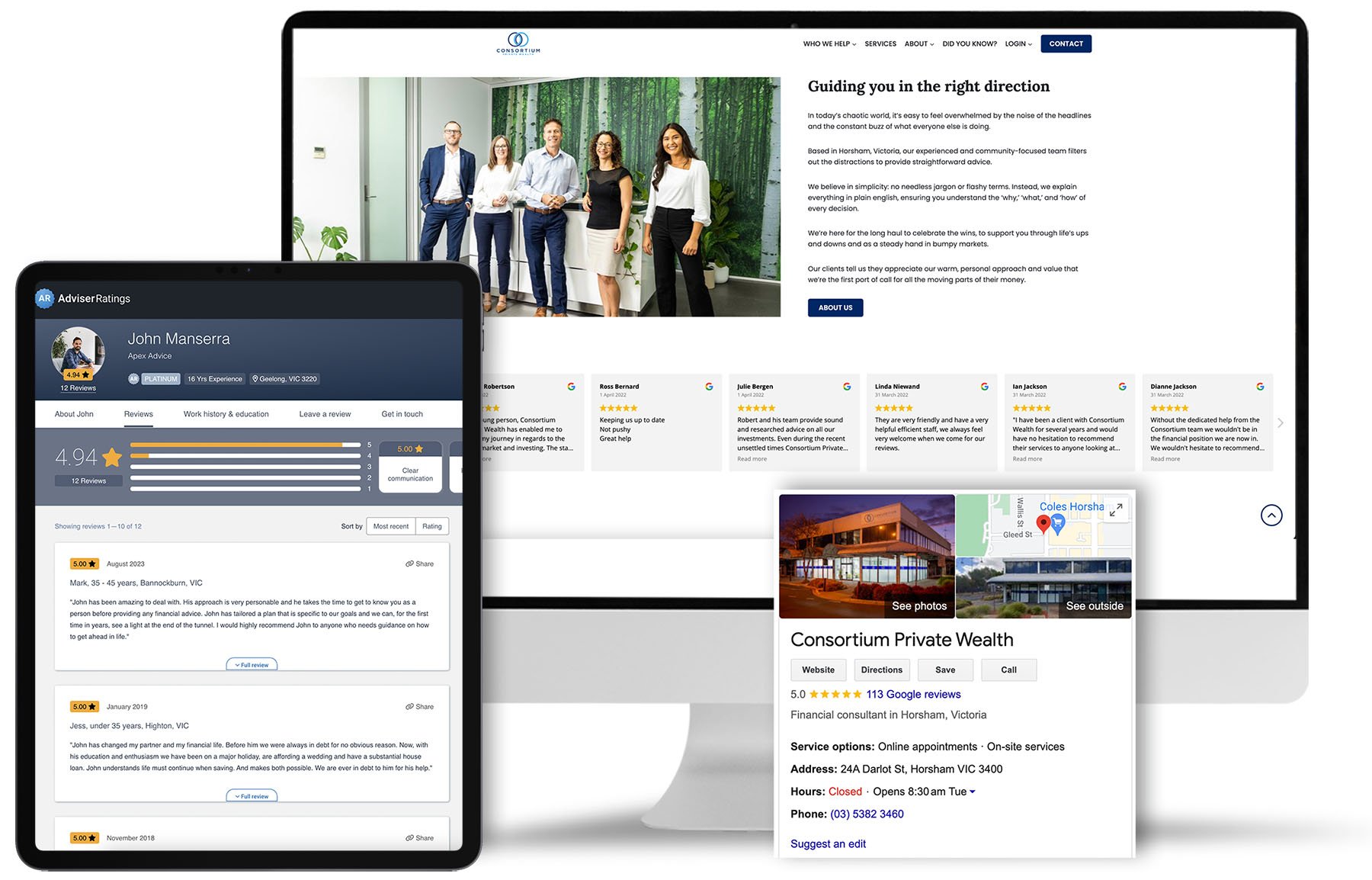

Utilise Google Reviews by encouraging your satisfied clients to leave a review, highlighting the positive impact your financial advice has on their lives. These reviews are often one of the first things prospective clients will see when they search for your services online, making them a critical component of your online reputation.

Adviser Ratings allows clients to rate your services and provides an avenue for you to showcase your professional achievements and client satisfaction scores. This platform offers an authoritative source of social proof for those researching your expertise.

LinkedIn is perfect for professional endorsements and sharing success stories that resonate with a business-minded audience.

Instagram and Facebook can humanise your brand, showcasing client testimonials and behind-the-scenes glimpses of your client interactions.

Your website should serve as the central hub, compiling the various forms of social proof you've collected. You don't want prospective clients to miss it.

Don’t forget about the power of video platforms like YouTube or Vimeo, where detailed client story videos can be shared. These stories can be further amplified by integrating them into your email marketing campaigns, reaching out directly to your audience's inbox.

Digital platforms should not only serve as channels for showcasing social proof but as integral parts of a cohesive marketing strategy. Incorporate social proof in content creation, SEO strategies, pay-per-click campaigns, and direct outreach efforts. This holistic integration enhances your overall marketing effectiveness, establishing a strong foundation of trust with both prospective and existing clients.

The impact of social proof on building trust

The impact of well-integrated social proof in building trust cannot be overstated. It transforms the abstract promises of financial security and prosperity into tangible outcomes. For prospective clients, seeing evidence of your success with others can be the deciding factor in choosing you as their financial advisor.

Moreover, social proof works not only to attract new clients but also to reassure your existing client base of their decision to trust you with their financial future. It creates a positive feedback loop that enhances your reputation and fosters community among your clients.

Navigating the challenges of social proof

One key challenge is ensuring authenticity. Social proof loses its power if it doesn’t ring true. Always seek genuine feedback and present it accurately. Maintaining privacy is also crucial - ensure you get consent before sharing any part of your client's stories. Consider that some clients may be happy to share their success but prefer to remain anonymous - it’s important to respect this.

Conclusion

In today’s digital age, where information is abundant but genuine trust is scarce, social proof stands out as a beacon of credibility for financial advisors. By strategically showcasing the successes and endorsements of those you’ve worked with, you build a foundation of trust with prospective clients before they even walk through your door. In the world of financial advice, where trust is paramount, social proof is essential.