The Swipe Right Client Safari: Finding Your Perfect Clients in the Wild

Let's start with some brutal honesty. According to Netwealth research, there are 4.7 million advisable Australians out there - that's 2.8 million Established Affluent plus 1.9 million Emerging Affluent.

But here's the thing - not all advisable humans are YOUR people.

Each financial adviser - a skilled guardian in the world of wealth management - can realistically nurture around 150 clients.

Like any ecosystem, the mathematics of survival are simple: quality over quantity.

The Cost of Unfocused Financial Adviser Marketing

When you try to be everything to everyone, you end up being nothing to anyone. Here's what the "anyone and everyone" approach actually costs you:

You become vanilla - pleasant enough but completely forgettable. You look and sound like thousands of other advice businesses.

You miss out on referrals - if clients and referral partners don't know who's worth referring to you, they'll keep quiet instead of being confident advocates.

You waste time on problem clients - energy vampires, tyre kickers, people who question your fees. You know the type.

Your processes get stretched thin - nothing is streamlined because you're serving completely different types of people.

Your team gets confused - without a clear vision of who you serve, everyone pulls in different directions.

You waste energy and money on diluted marketing - you're spraying and praying, which is pointless in this noisy, attention-deficit world we live in.

What Makes Someone a Perfect Client?

Here's how you know you've found a perfect client:

They:

Value your work - they trust you and see you as an expert

Click with your vibe - when they read your content or hear you speak, they think "this person gets me"

Pay what you're worth - because they understand the value you bring to their lives

Refer others like them - and those referrals are quality people, not random tyre kickers

And here's what this means for you:

You feel energised instead of exhausted - Monday mornings don't fill you with dread.

You can charge premium fees - because you're working with people who value advice from someone who specialises in helping people like them.

You make a real impact - because you're helping people who genuinely want your help.

You build a reputation as THE business for your type of client.

When you nail this, something magical happens. Monday mornings don't fill you with dread. You can charge premium fees. You make a real impact because you're helping people who genuinely want and value your help.

The Adviser Evolution: From Generalist to Thriving Practice

After over two decades in the financial advice industry, I've noticed that advice businesses typically follow a similar marketing path:

The Generalist - taking anyone who'll pay you. You're grateful for any client because you need to build your practice.

The Questioner - you start wondering if there's a better way. You notice some clients energise you while others drain you. You ask yourself 'why do I love working with Sarah but dread meetings with Bob?'

The Explorer - you start experimenting. Maybe you focus on retirees, or small business owners, or young professionals.You're testing what feels right.

The Go-To Expert - you pick your lane and own it. People start saying 'if you need help with X, talk to Jane - she's the expert.'

The Thriving Practice - you're known for helping specific people solve specific problems. Your calendar is full of clients you love, your fees reflect your expertise, and referrals flow naturally.

The reality is, most advisers get stuck somewhere between Questioner and Explorer. They know the 'anyone and everyone' approach isn't working, but they're scared to narrow down because they think it means turning away business.

Here's the truth: narrowing down doesn't shrink your market - it sharpens it.

The Client Safari Method: A Strategic Marketing Framework for Financial Advisers

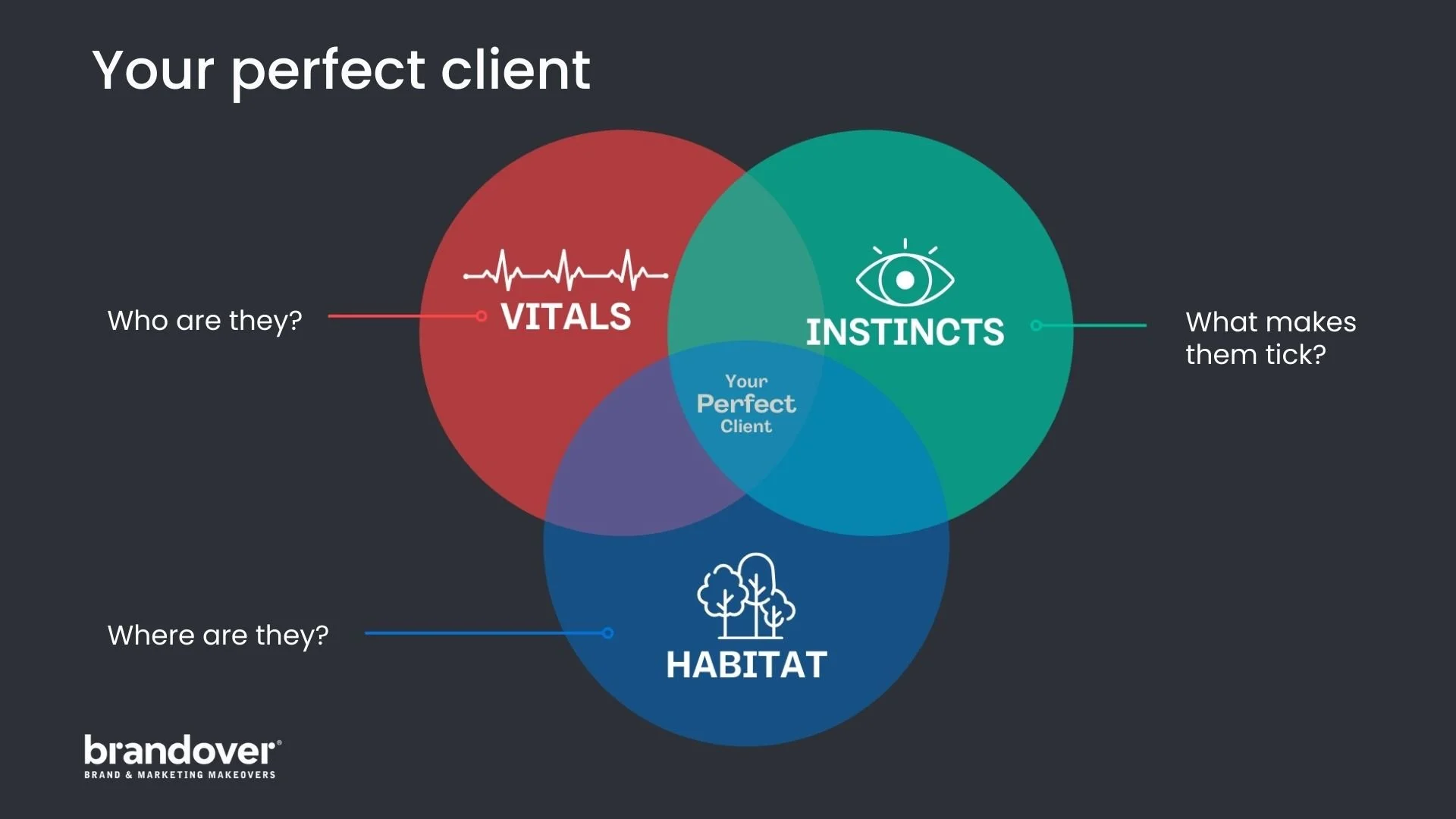

To find your perfect clients, you need to track three vital elements.

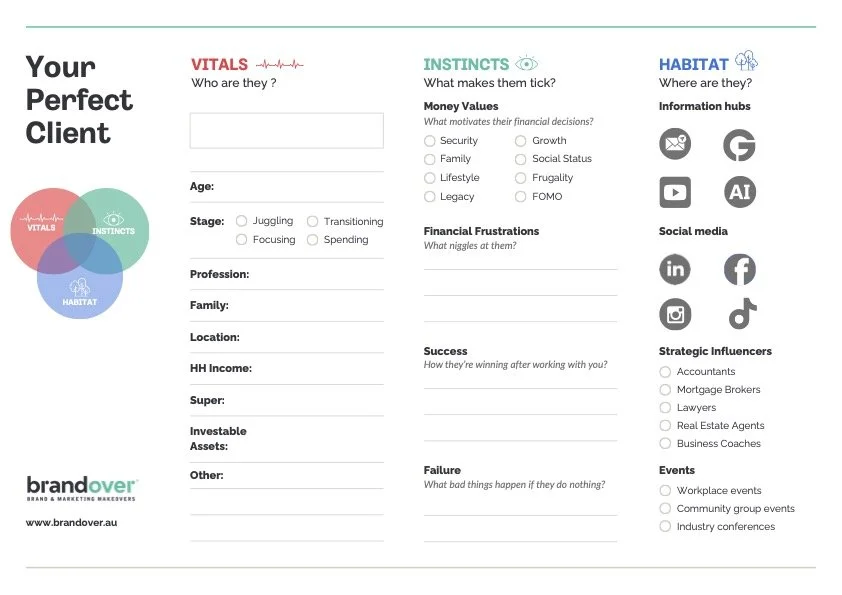

1. VITALS - Who They Are

This goes beyond basic demographics. Yes, you need to know their age, profession, family situation, and financial position. But the real magic happens when you understand their life stage.

Age and stage are different beasts. People are having kids later, changing careers multiple times, caring for aging parents while supporting adult children. You can't generalise based on age alone.

Are they:

Juggling (little kids, careers, mortgages)

Focusing (more headspace as kids get older, peak earning years)

Transitioning (kids financially independent, thinking about what's next)

Spending (in retirement or semi-retirement)

2. INSTINCTS - What Makes Them Tick

This is where you get inside their heads. What drives their money decisions?

Values - Is it security, family, lifestyle, growth, social status, or something else entirely? These values directly impact how they make financial decisions.

Frustrations - What's bugging them day-to-day? Time-poor? Directionless? Disorganised? These frustrations are what drive them to seek advice.

Success - What does winning look like to them? Guilt-free spending? Clear future plans? Options and flexibility?

Failure fears - What keeps them up at night? Being stuck in their job forever? Missing out on family memories? Financial stress destroying relationships?

3. HABITAT - Where They Hang Out

Once you know who your ideal client is, you can work out where you actually need to be visible. Not everywhere - just where it matters.

Think about four key areas:

Information channels (email, Google, AI tools, YouTube)

Social media (but be strategic - different platforms serve different demographics)

Strategic influencers (accountants, mortgage brokers, business coaches, fitness trainers)

Events (workplace events, community groups, industry conferences)

Marketing Strategies for Financial Advisers: The Three-Step Action Plan

Step 1: Get Specific

Profile your ideal clients using the VITALS, INSTINCTS, and HABITAT framework. Don't profile a group - profile a person. One specific human or couple. Think like them, feel like them, be as specific as you possibly can.

Step 2: Test Your Message

Google yourself through their eyes. Does what you find online speak directly to someone like them? If not, fix what people are finding when they search for you.

Step 3: Show Up Where They Hang Out

Pick ONE habitat to focus on for the next 90 days. If you don't have solid email communications sorted, start there. Then over time, extend the reach of your content by sharing your perspectives on the social platforms, events and with strategic influencers.

Remember: slow, steady and strategic will result in compounding benefits. It takes time and consistency.

The Bottom Line for Financial Adviser Marketing

In the attention-deficit economy we live in, you can't afford to be everything to everyone. The advisers who thrive are the ones who pick their lane and own it completely.

Your perfect clients are out there. They're looking for someone who gets them, speaks their language, and understands their world. The question is: will they find you, or will you remain invisible in the sea of sameness.

Ready to find your perfect clients in the wild? Grab the Perfect Client Safari map and start tracking your ideal species today.

The Brandspark® is the gateway to transforming your financial brand to be the choice for quality clients who swipe right, stick around and spread the word. Learn more about Brandspark®.